Packing the essentials—comfortable walking shoes, sunglasses, your lucky golf socks—is a must when you travel. Another prerequisite for a worry-free trip? A travel medical insurance plan from AMA Travel*.

“People may hesitate to purchase travel medical insurance because of the cost,” says Pam Murray, insurance sales manager at AMA Travel. “But without coverage, even if you’re just in another Canadian province, you could end up spending thousands of dollars if an unexpected illness or accident occurs.”

According to a 2013 study by the National Institutes of Health in the United States, a simple trip to a U.S. emergency room can cost between $1,000 and $2,000 USD. Recent AMA Travel claims have included a back surgery with 10-day hospital stay in South Dakota that rang in at $250,000, and an angioplasty plus single stent insertion in Mexico that resulted in a $184,000 bill. Those are not the kind of souvenirs you want to bring home.

Protecting yourself from these costs is now more affordable: You can reduce your premium by adding a deductible to certain insurance policies from AMA Travel.

HOW TO DECREASE YOUR PREMIUM

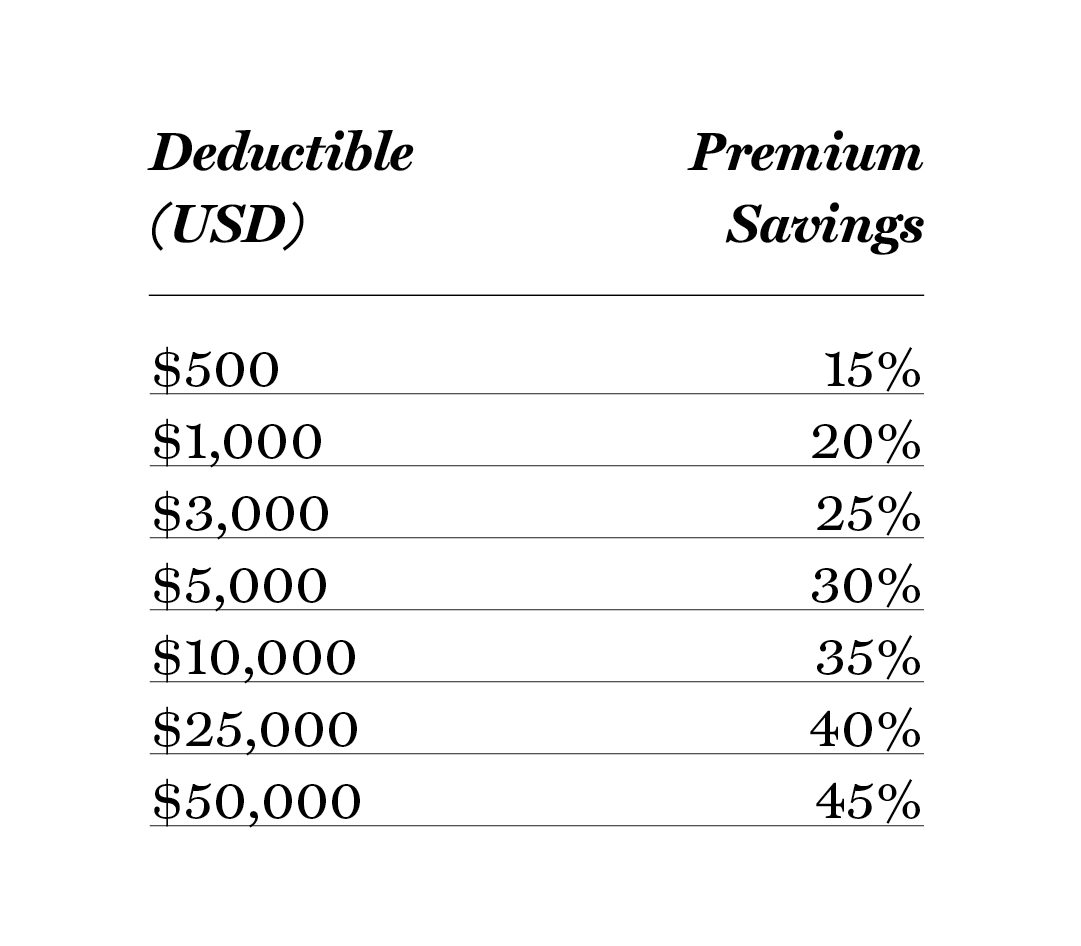

Depending on how much of a deductible you’re willing to take on, it’s possible to lower the premium on some plans by up to 45 percent. (Check with your AMA Travel counsellor to learn which plans are eligible.) Here’s how much you can save on AMA Travel medical insurance:

Murray says long-term travellers—such as snowbirds, people taking an extended trip to visit family, or adventurers on the trek of a lifetime—will benefit most by adding a deductible, since your age and the length of your trip are significant factors in the cost of insuring any out-of-province travel.

Deductibles can be added to single-and multi-trip plans and top-ups. Packaged plans, however, are not included. In the case of top-ups, the deductible amount must be equal to or greater than the amount of the multi-trip plan being topped up.

Also of note: While AMA Travel medical insurance premiums are charged in Canadian dollars, Murray says your deductible is payable in U.S. dollars or the equivalent Canadian amount.

HOW YOUR DEDUCTIBLE WORKS

In the event of an illness or accident, you must pay the deductible amount at the hospital or care facility. For example, if your spouse breaks a leg, the hospital will contact AMA Assistance, which then informs the hospital of your deductible—let’s say it’s $5,000 USD.

“You need to be able to access that $5,000 right away,” Murray says. “It’s not a case of raising the $5,000 or getting it out of your RRSP.’” Keep this in mind when determining which deductible amount is right for your needs.

Murray says that many of her well-travelled clients carry a credit card in U.S. funds for that purpose, with a limit equal to the amount of their insurance deductible. They know they’ll have the deductible amount available, but the hospital won’t be able to charge further amounts that their AMA Travel policy covers.

“In the event of an emergency, call 911,” Murray advises. “But if your medical need is less urgent, call us at AMA Assistance (1-866-989-6595). The number is on the back of your insurance wallet card and on the policy. We know the facilities in the area and know where you should go for proper care. Let us help you. After all, that’s what you’ve paid for.”

WE’VE GOT YOU COVERED

For more information on deductibles and travel medical insurance, and to get a free quote, visit AMATravel.ca/TravelInsurance or call 1-866-989-6595.