You’ve bought the plane tickets, booked the perfect hotel room and bought emergency travel medical coverage. But the night before you take off, a pipe bursts in your basement leaving your home a soaking mess and dampening your travel plans. Suddenly, you’re up to your ankles in water and travel debt—unless you purchased trip cancellation and interruption insurance.

“People plan to travel as scheduled, but life can sometimes get in the way,” explains Pamela Murray, AMA Travel’s sales manager of travel insurance. “That’s why you shouldn’t book a trip or travel without adequate protection, including cancellation and interruption coverage.”

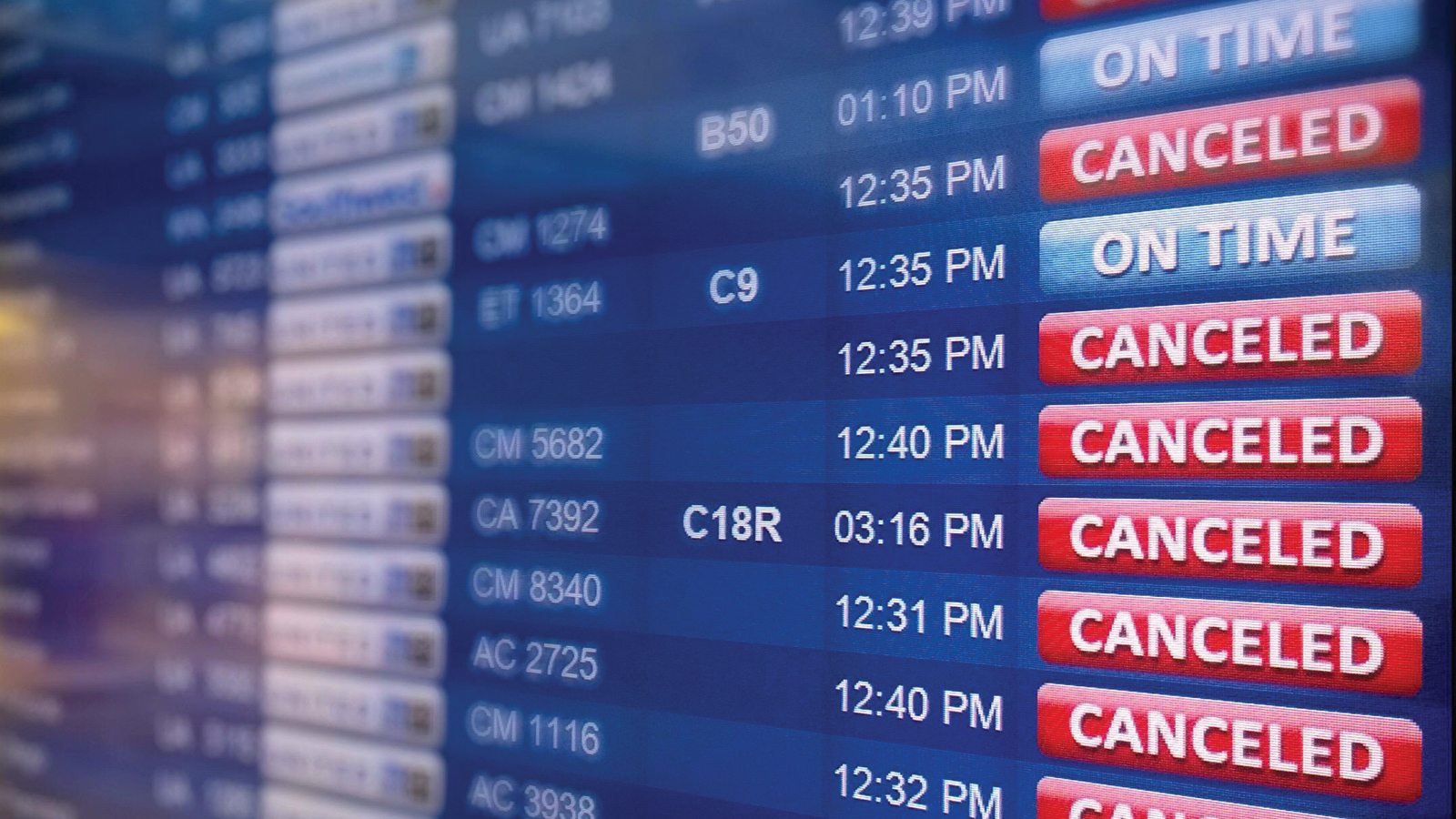

Trip cancellation insurance covers the penalty imposed by an airline, tour operator or cruise line if you cancel a trip. If it’s far out from the departure date, you might only lose your deposit. But if it’s closer to take-off or departure, an operator isn’t likely to refund anything.

MORE TO READ

Adventure tourism and insuring yourself against risk

Trip interruption insurance covers your out-of-pocket expenses that could be incurred if you need to return home in a hurry due to a family member’s illness or death, or a disaster at home. This claim would reimburse the cost of a change fee on your airline ticket or a new one-way ticket home, plus hotel, meals and taxi fares en route to your home. Interruption coverage may also reimburse the cost of the portion of the trip that you’re missing.

Trip interruption also covers you if you encounter major delays during your trip, things like a weather-related airline delay that causes you to miss a day or two at your all-inclusive resort. “Airlines are responsible when an issue is their fault—mechanical problems or cancelled flights due to overbooking, for example. But if there’s a weather issue, they aren’t responsible and are not obligated to provide meals or accommodation,” Murray explains. But a trip interruption policy would cover those costs.

MORE TO READ

Five reasons to buy an annual travel medical insurance plan

To cover the unexpected, AMA Travel* offers different insurance packages that include cancellation and interruption coverage. “Our counsellors have seen many of their own clients experience the agony of cancellation and the joy of getting their money back with their AMA Travel Insurance policy,” Murray adds. AMA’s knowledgeable travel specialists will work with you to find the right insurance package to ensure you always have a plan B.

DON’T FORGET!

Important notes about trip cancellation and interruption insurance

• The policy must be purchased at the same time that you book your trip.

• Cancel for Any Reason is bonus coverage you get when booking with AMA Travel. With a cancellation policy, it allows you to cancel for any reason (terms and conditions apply) up to 24 hours before departure and recover 50% of your costs.

• If you booked with AMA Travel and need to cancel, advise your travel counsellor immediately. Otherwise, notify your airline, tour operator or cruise line. If you wait too long, applicable penalty charges may go up in price, reducing the amount you can recoup. AMA Travel policies will pay the penalty within 72 hours of the cause of cancellation.

Call 1-866-989-6595 or visit AMA Travel online to learn more about trip cancellation and interruption insurance