Regularly reviewing your bills and credit card statements makes good financial sense, yet not all Canadians take the time to check in on their credit history. Here’s why you should periodically examine this important report, what to look for and what to do if you find an inaccuracy.

WHAT IS YOUR CREDIT HISTORY?

“Credit history is obtained once your first credit card, automotive loan or bank loan is granted, and it builds from there,” says Dave Terletski, director, enterprise risk management for Bridgewater Bank, a wholly owned subsidiary of AMA.

Also referred to as a credit report or credit file, you can check your credit history through a credit bureau. The report contains information about the companies and financial institutions with which you have accounts (i.e. your existing debts and payment habits), as well as details related to your employment, estimated assets and more. Credit information remains on your file for at least six years.

WHY CHECK IT?

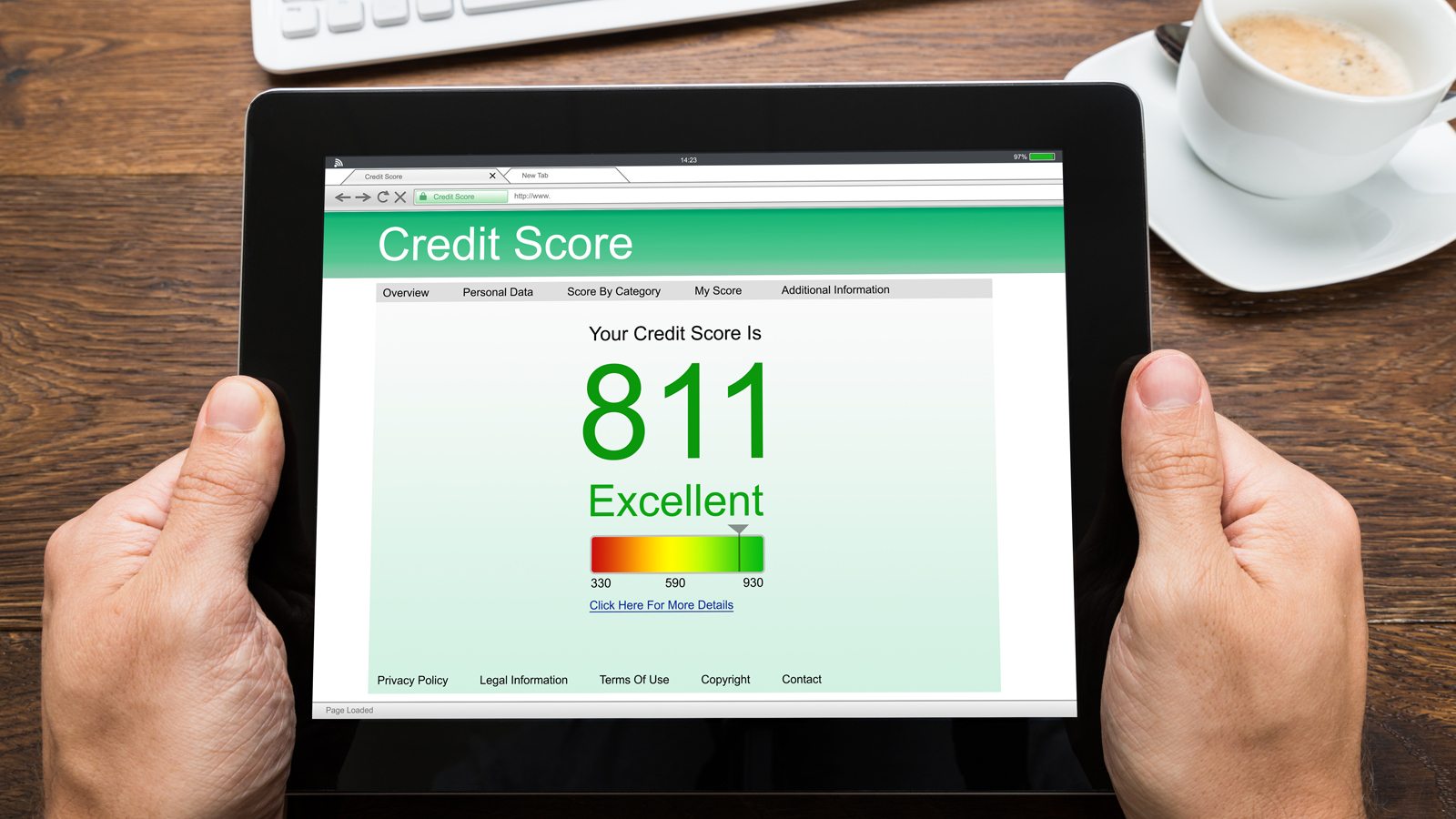

Knowing your credit history becomes more important when you’re preparing to make a large purchase, such as a car or home. Your history is associated with a credit score (a figure from 300 to 900, with a higher number indicating stronger credit), which lenders use, in conjunction with your history, to evaluate your suitability for credit. Insurers may also look at your credit score in order to determine the rates they offer to you.

But even when you aren’t looking for a loan or insurance policy, checking your credit history is a good idea.

PROTECT YOUR PAPERS

AMA can help you securely get rid of important but no-longer-needed documents at our members-only shredding events—and anytime with secure document disposal at AMA centres

HOW TO CHECK IT

It’s recommended that you check your credit history every 12 months. Trusted and professional services allow you to obtain a report—not including your credit score—for free by mail. For an additional fee, you can review your credit history and score as often as you wish online.

Despite what people may think, making multiple personal requests for a report does not negatively impact your credit score. However, numerous inquiries made over a short period by lenders evaluating your creditworthiness? Terletski explains those inquiries will have a negative impact on your credit score. “The more applications you have out in a short period of time, the more likely your score will be driven downward.”

Once you’ve gained access to your credit history, you should:

• Review your personal information listed on the report(s) to ensure it’s accurate.

• Confirm that all loans and accounts itemized on the credit report are indeed yours. Note that closed accounts may still appear on file for a period of time.

• Check the Inquiries section, which lists any requests for your credit history (including the date, the business or bank that made the inquiry, and its contact phone number). These requests are made when you apply for a loan, credit card or other financial product.

WHAT TO DO IF SOMETHING’S AMISS

There are steps you can take if you note any suspicious inquiries or accounts on your credit history.

If you don’t recognize a listed creditor, double-check it. Some store cards are provided by third-party financial institutions: The Hudson’s Bay card, for example, is issued by Capital One.

ID THEFT ASSISTANCE

AMA Insurance offers coverage for identity theft on home insurance policies

As for inquiries from companies you haven’t applied to or haven’t received credit from, take immediate action. You should first contact the requesting institution at the listed phone number, to investigate whether the query is related to identity theft or fraud. Then call the credit bureaus to notify them of your concerns. If identity fraud is suspected, you should be able to have an alert placed on your account, which tells lenders to confirm with you by phone whenever an application is made to them in your name. And consider filing a report with your local police department.

For other items appearing on your credit history that you disagree with, you have a right under Alberta’s Fair Trading Act to explain or protest what you’ve found. Contact the reporting agency that provided report to find out how to update it.

Even if your credit history is completely accurate and up-to-date, keeping abreast of it is just good sense.

“Credit takes years to earn but just months to destroy,” Terletski says. A little effort to ensure that no one is interfering with your creditworthiness has a big payoff in peace of mind.