An accurate and detailed list of everything in your abode can help you replace your prized possessions in the event of burglary, fire, flood or other maison mishaps.

Here’s how to take stock and help you to make sure your coverage doesn’t fall short when you need it the most.

KEEP YOUR POLICY CURRENT

“Keeping files up to date can help prevent surprises if something were to happen,” says Steve Kee, director of media and digital communications for the Insurance Bureau of Canada. Kee recommends taking a complete inventory of your home’s contents annually, or more frequently if your circumstances change.

Over time you accumulate more possessions or perhaps purchase pricey items like jewellery and artwork. “I always look at things and think, ‘What is the worst case scenario?’” Kee says. “You just want to make sure your insurance is reflective of your current situation.” For those big-ticket items, check your policy’s limits; you might need extra coverage.

CREATE AN EXHAUSTIVE INVENTORY

There are no hard rules on how to inventory your home’s contents. Whether you jot down a list or make a spreadsheet, being thorough is what’s important.

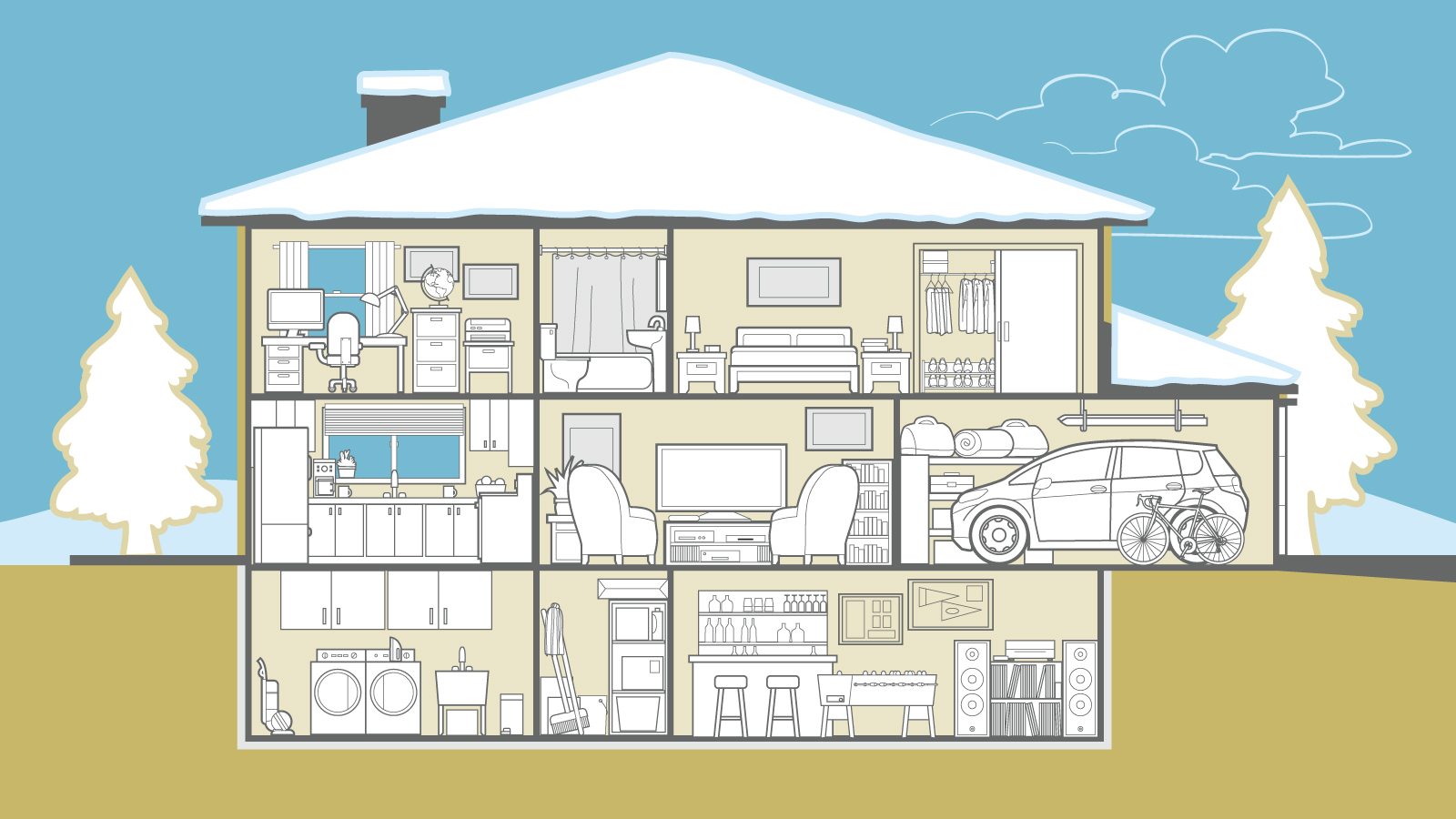

Rifle through every room, closet and crawlspace to itemize everything, from your well-loved IKEA cutlery and kitchen linens to the camping gear and tools stashed in the garage. Note the make, model and age of items, being as specific as possible, and document serial numbers. Such details help insurance adjusters identify what was lost or destroyed, identify similar products for quotes, and determine replacement and depreciation values.

Consider making videos or taking photos of the rooms in your home as well as individual items. (Family heirlooms rarely come with receipts.) This can be a valuable way to verify details if you need to make a claim. Sometimes you don’t know the true value of obscure items, such as a treasured hockey card collection, until your insurance adjuster tries to determine its replacement cost. Retain receipts, warranties and appraisals, especially for valuable possessions. “It’s your proof of ownership and the age and value of items,” Kee says.

When you’ve finished, make and keep multiple copies of your inventory—at the office, in a safety deposit box or saved in the cloud for quick retrieval.

CONSIDER YOUR COVERAGE

Your home (including the land it’s on) may appreciate over time, but its contents typically depreciate. That’s why it’s essential to not just read your policy, but to understand nuances, such as actual cash value (ACV) versus replacement cost (RC). For instance, if you purchased a TV for $1,000 five years ago and tried to sell it today, the market value would be significantly less. The ACV is similar: It’s calculated by determining the replacement cost of the item and subtracting depreciation.

While it’s generally considered a better option, RC has intricacies too. If you lost the home completely, insurance would cover the cost of materials and labour to rebuild your home up to your policy limit.

If you make a claim, don’t bank on taking the money and pulling up stakes. Most policies have requirements under replacement cost including that the home be rebuilt on the same site.

Many comprehensive policies include guaranteed replacement cost coverage for your home or make it available to purchase. This provides coverage to rebuild your home even if the costs exceed your home’s limit of insurance. There are conditions that must be met to use this option.

UPGRADE YOUR HOME, UPGRADE YOUR POLICY

Whether you’re rebuilding after a loss or renovating, remember that upgrades can significantly add value to your home—especially kitchens and bathrooms, which typically offer the highest return on investment. Such improvements can also affect how your property is rated, so let your insurance advisor know when you renovate, Kee advises. If you don’t tell your insurance company about significant upgrades, the cost to repair or replace those upgrades may not be covered. If you’re not sure whether your upgrades are significant, ask your insurance advisor!

TO CLAIM OR NOT TO CLAIM?

If the time comes to consider making an insurance claim, first weigh the cost of your deductible against your estimated loss. Your deductible will be subtracted from the amount your insurance pays toward your claim. If you have a $1,000 deductible, for instance, forgoing claim-free status for a stolen camera worth $1,200 might not be worth it to you.

Kee offers two parting pieces of advice: Scrutinize your policy and talk to an insurance representative for expert advice. “Insurance is there to protect you and help you recover in times of crisis.”

WHAT’S IT WORTH?

You’re not likely to forget the TV, fridge, furniture or washing machine, but don’t forget all the little things that add up too:

• Kitchen – countertop appliances, place settings and cutlery, pots and pans

• Laundry room – iron or steamer, vacuum

• Home office – tablets, desk accessories

• Bedroom – book collection, clothing, shoes, accessories

• Living room – art and collectibles, gaming system, PVR/streaming device

• Garage – camping gear, ski equipment, bicycles

• Basement – hockey and baseball cards, memorabilia and antiques, record collection

ASK AN ADVISOR

Questions to ask your insurance advisor to make sure you’re covered:

• What does my home insurance policy cover?

• Is there a specific kind of insurance for the type of home I live in?

• Are there certain risks not covered by my policy?

• What is a deductible? And how does it affect the cost of my home insurance?

• Am I entitled to any discounts?

• Is my home business covered by my home insurance policy?

• Should I make a claim for every loss?

To learn more, see AMAInsurance.ca/Home

This article is intended for general information purposes only. All policies are subject to various terms, conditions, limitations, and exclusions that may limit coverage.